When you think of government regulators, you probably imagine watchdogs protecting you-from clean air and safe drugs to fair banking and reliable power. But what if those watchdogs have become part of the pack? That’s regulatory capture: when the agencies meant to control industries end up serving them instead. It’s not conspiracy. It’s systemic. And it’s happening right now, in plain sight.

What Regulatory Capture Really Looks Like

Regulatory capture isn’t about bribes or backroom deals (though those happen too). It’s subtler. It’s when the people meant to enforce rules start thinking like the people they’re supposed to police. They adopt the industry’s language, priorities, and fears. Over time, the regulator stops seeing itself as a guardian of the public and starts seeing itself as a partner to business. This isn’t theory. It’s documented. The U.S. Securities and Exchange Commission (SEC), tasked with protecting investors, had staff who moved back and forth between Wall Street firms and the agency. By 2011, the Financial Crisis Inquiry Commission found that 87% of major Wall Street firms had direct revolving door ties to SEC staff. The result? Oversight of $23 trillion in risky derivatives was ignored until it was too late. In the UK, energy regulator OFGEM approved £17.8 billion in bill increases between 2015 and 2020 for network upgrades. Yet, energy companies kept profit margins at 11.2%-nearly double the 6.8% limit set by the regulator. Consumers paid more. Shareholders got richer. The regulator? It didn’t push back.The Three Ways Capture Happens

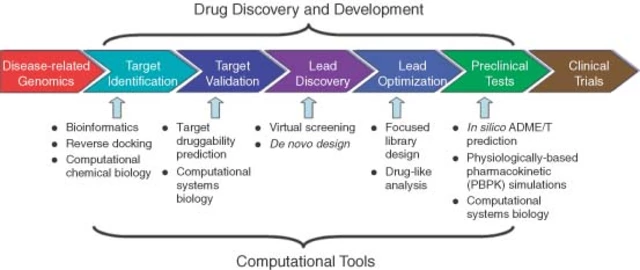

There are three main paths to regulatory capture-and they’re all happening right now. First, materialist capture. This is the obvious one: money. Industry gives political donations. Former regulators get high-paying jobs in the companies they once oversaw. The U.S. Department of Defense saw 53% of its top officials join defense contractors within a year of leaving government between 2008 and 2018. That’s not coincidence. It’s incentive. Second, cultural capture. This is quieter, but just as dangerous. Regulators spend years talking to industry experts, attending their conferences, reading their reports. They start to trust them. They begin to believe that what’s good for the company is good for the public. The result? Enforcement gets softer. Deadlines get stretched. Violations get excused as "industry best practices." Third, information asymmetry. Regulators don’t know how a new drug works, how a cryptocurrency algorithm runs, or how a power grid balances supply. The industry does. So regulators rely on the industry to provide the data, the models, the risk assessments. That’s not just convenience-it’s dependency. And dependency leads to control.

Why It’s So Hard to Stop

You’d think the public would push back. After all, we’re the ones paying the price-higher drug costs, dirty air, unstable power, rigged markets. But here’s the catch: the costs are spread out. Every American household pays about $33 a year more for sugar because of tariffs that protect 4,318 domestic producers. Individually, that’s barely noticeable. But collectively? $3.9 billion a year in extra costs. Meanwhile, the sugar industry spends millions lobbying, funding think tanks, and shaping the narrative. They have a clear, concentrated interest. The public? We’re distracted, busy, and unaware. And that imbalance is by design. Research shows industry groups spend 17.3 times more per person on lobbying than consumer groups. In the U.S., industry political contributions outspend consumer groups by 22.4 to 1. That’s not a market failure. That’s a power imbalance built into the system.Real Cases, Real Harm

The sugar tariff is one example. The Boeing 737 MAX is another. The FAA, responsible for aviation safety, delegated 96% of the plane’s safety reviews to Boeing employees. When the planes crashed, killing 346 people, the investigation found regulators had been too close to the manufacturer. They trusted the company’s own safety reports. They didn’t question them. In the UK, HM Revenue and Customs ran "Project Merlin" from 2012 to 2019. It gave 1,842 multinational corporations confidential tax deals averaging £427 million each-while publicly claiming corporations paid a 19% tax rate. The public never knew. The regulators didn’t enforce. The companies saved billions. Even in pharmaceuticals, former FDA officials who left government to join drug companies were linked to a 28-day average delay in enforcement actions. That’s not just a gap. That’s a loophole.

Who’s Fighting Back?

Some places are trying. Canada introduced "Regulatory Integrity Training" for officials. It cut industry meeting times by 27% and boosted public stakeholder input by 43%. New Zealand’s independent review process dropped industry-preferred regulations from 68% to 31% between 2016 and 2022. The European Commission now requires at least 40% consumer representation on advisory panels. The U.S. Federal Trade Commission launched its own "Regulatory Capture Initiative" in March 2023, with a $23 million budget and mandatory disclosure of all industry contacts. But these are exceptions. Most reforms fail. Between 2015 and 2022, 78% of proposed anti-capture laws in the U.S. never passed. Why? Because the industries that benefit from the status quo have the money, the access, and the influence to block them.What You Can Do

You won’t fix regulatory capture alone. But you can help expose it. - Demand transparency. Ask: Who advises the regulator? Who funds them? Who’s on their board? - Support independent watchdogs like Public Citizen, Transparency International, or local consumer groups. - Pay attention to "revolving door" hires. When a regulator leaves for a company they once oversaw, ask why. - Vote for officials who prioritize oversight over industry comfort. Regulators aren’t neutral. They’re shaped by who they listen to. The system isn’t broken. It’s working exactly as designed-for the few who profit from it. The question is: who are you willing to let win?What is regulatory capture?

Regulatory capture occurs when government agencies created to protect the public end up advancing the interests of the industries they’re supposed to regulate. This happens through financial incentives, cultural alignment, or reliance on industry-provided information-leading to weaker rules, lax enforcement, and policies that favor corporations over consumers.

Is regulatory capture the same as corruption?

Not exactly. Corruption involves illegal acts like bribery or embezzlement. Regulatory capture is often legal-it’s about influence, access, and relationships. A former regulator taking a job at a company they once oversaw isn’t illegal, but it creates a conflict of interest that undermines public trust. The harm isn’t always in the violation-it’s in the erosion of accountability.

Which industries are most affected by regulatory capture?

The financial sector has the highest rate of capture at 67%, followed by energy (58%) and pharmaceuticals (52%), according to the World Bank’s 2022 assessment. These industries have high profits, complex regulations, and strong lobbying power. The sugar industry, for example, spends heavily to maintain tariffs that cost consumers billions while protecting a small group of producers.

How does the revolving door contribute to regulatory capture?

The revolving door refers to officials moving between regulatory roles and industry jobs. When regulators know they’ll get a high-paying job in the industry after leaving government, they’re less likely to enforce tough rules. Research shows 92% of former SEC commissioners took positions with regulated firms within 18 months of leaving office. This creates a chilling effect: regulators self-censor to avoid burning bridges.

Can regulatory capture be reversed?

Yes, but it requires structural change. Canada’s training programs reduced industry meeting times and increased public input. New Zealand’s independent review process cut industry-preferred regulations by more than half. Transparency, mandatory cooling-off periods, and public representation on advisory panels are proven tools. But they only work if there’s political will-and that’s the biggest obstacle.

Why don’t more people know about regulatory capture?

Because the costs are invisible. You don’t see the regulator bending the rules-you just pay more for sugar, medicine, or energy. The industry controls the narrative, funds think tanks, and shapes media coverage. Meanwhile, the public is overwhelmed by daily concerns. Regulatory capture thrives in silence. Awareness is the first step to change.

Taya Rtichsheva December 9, 2025

so like... regulators are just corporate interns now? 🤡

they get the cool job after grad school, then go work for the guys they were supposed to shut down. no wonder my electricity bill keeps rising

Evelyn Pastrana December 10, 2025

i live in texas and let me tell you, the power companies act like they own the grid. when the freeze hit, the regulators were too busy sipping coffee with the execs to fix anything. we froze for days and they gave bonuses. that's not oversight, that's betrayal

Nikhil Pattni December 11, 2025

ok but let's be real here - this isn't just america. in india we have the same thing with pharma and food safety. the fda equivalent here lets companies self-certify everything. one time a company tested their own baby formula and said it was 'safe' because it didn't kill the lab rats. the rats were already dead. the regulators didn't even check the data. they just stamped it. and now parents are suing because their kids got sick. this is global. it's not a bug, it's the system

Elliot Barrett December 12, 2025

why are we even surprised? the whole system is rigged. you think the guy who wrote the rules is gonna punish his future boss? lol

Andrea Beilstein December 14, 2025

it's funny how we blame individuals when the structure itself is the problem. we treat regulators like moral agents when they're just cogs in a machine designed to serve capital. the real question isn't who's corrupt-it's why we keep building systems where corruption is inevitable

we don't need better people. we need different rules

Sabrina Thurn December 15, 2025

the revolving door is the silent killer here. when a regulator knows their next paycheck is tied to the industry they're supposed to police, they don't need a bribe. they just need to wait. the incentives are baked in. the solution? mandatory 5-year cooling-off periods, public funding for oversight agencies, and rotating advisory panels with real consumer reps-not corporate PR flacks. it's not rocket science, it's just inconvenient for the powerful

Richard Eite December 17, 2025

this is why america is falling apart. we let suits write the rules and now we pay for it. the left wants more regulation, the right wants less. both sides are wrong. we need to burn the whole system down and start over with people who don't have ivy league degrees and yacht clubs

Tim Tinh December 19, 2025

i used to work at a small regulatory firm. we had to submit all our reports to the industry group for 'feedback' before sending them to the agency. i thought that was weird. my boss said 'it's just how it's done'. one day i asked why. he just smiled and said 'you'll understand when you get your next raise'. i quit the next week. it's not conspiracy. it's just... normal

Stacy Tolbert December 19, 2025

i just cried reading this. my mom died because the FDA approved a drug that was supposed to help her. the company paid the regulators to skip phase 3 trials. no one ever got punished. i just want someone to say it was wrong. but no one will. because it's legal

Ryan Brady December 19, 2025

lol america is so soft. in russia they just shoot the corrupt regulators. problem solved. we need more of that here. 🤡🔫

Raja Herbal December 21, 2025

you know what's worse than capture? when the public doesn't even care. i showed my cousin this article and he said 'so what? i just want my phone to work'. that's the real enemy. apathy. the industry doesn't need to bribe everyone. just the ones who vote