Brand-name drugs can cost hundreds - sometimes over a thousand - dollars a month. If you’re paying out of pocket, that’s a huge hit to your budget. But here’s the thing: manufacturer savings programs can cut those costs by 70% to 85%. For many people, they’re the only way to afford essential medications like insulin, asthma inhalers, or rheumatoid arthritis drugs. The catch? Not everyone qualifies. And even if you do, there are hidden rules that can leave you stranded if you don’t know them.

What Are Manufacturer Savings Programs?

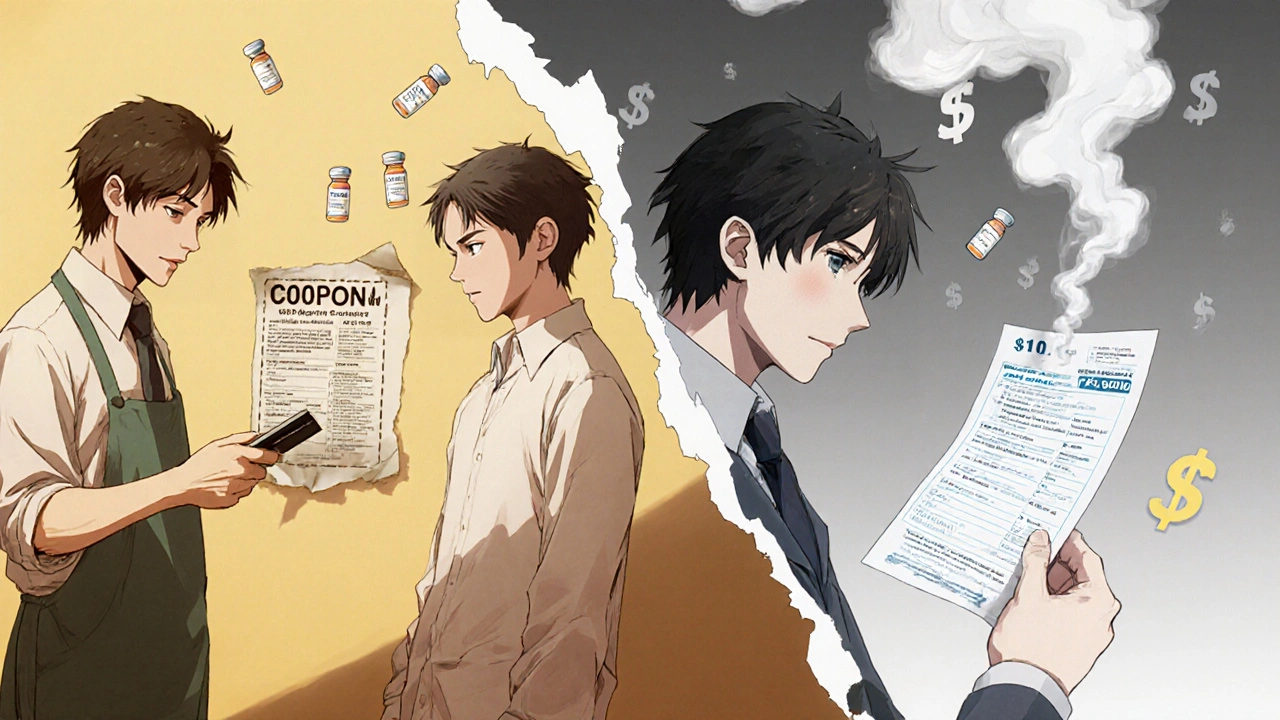

These are discounts offered directly by drug companies - not your insurance - to help you pay for brand-name medications. They come in two main forms: copay cards and patient assistance programs (PAPs). Copay cards are the most common. You sign up online, get a digital or physical card, and present it at the pharmacy. The manufacturer covers most of the cost, and you pay just a small copay - often $5 to $50 per month.Patient assistance programs are usually for people with very low income or no insurance. They may give you the drug for free or at a deeply reduced price. But for most people with private insurance, the copay card is the go-to option.

These programs exploded after 2005, when drug prices started climbing faster than wages. Today, nearly every major brand-name drug - from Humira to Jardiance - has one. In 2023, about 19% of all prescriptions for privately insured patients used manufacturer savings. That’s over $23 billion in discounts paid out in a single year.

Who Can Use These Programs?

This is where people get tripped up. You cannot use these programs if you’re on Medicare, Medicaid, or any other federal health program. It’s illegal. The federal anti-kickback law bans drug companies from giving discounts to people on government plans because it could push them toward pricier brand drugs instead of cheaper generics.That means if you’re on Medicare Part D, you’re out of luck - unless you’re getting insulin. Thanks to the 2022 Inflation Reduction Act, insulin costs are capped at $35 per month for Medicare users. That’s one of the few exceptions.

For everyone else - people with private insurance through an employer, a spouse, or the marketplace - you’re likely eligible. But your insurance plan might still block you. Many insurers now use something called an accumulator adjustment program. That means the manufacturer’s discount doesn’t count toward your deductible or out-of-pocket maximum. So even if you’re paying $10 a month thanks to the coupon, your insurance still treats you as if you paid the full $500. That can delay or even prevent you from reaching your out-of-pocket limit, which means you’ll keep paying high costs longer.

How to Find and Enroll in a Program

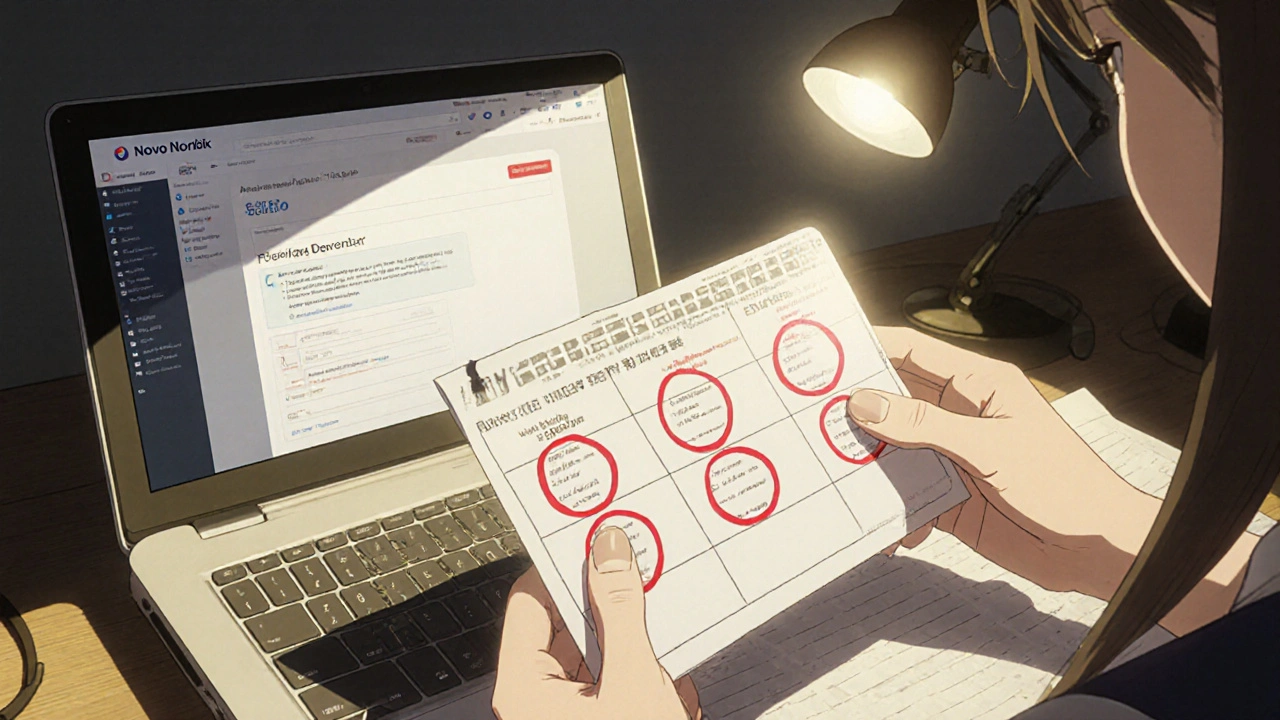

Start with the drug’s manufacturer. Go to their official website and search for “patient assistance” or “savings program.” Most have a dedicated page. For example, if you’re on Ozempic, go to Novo Nordisk’s site. If you’re on Advair, go to GSK’s.Or use a free aggregator like GoodRx. Type in your drug name and look for the “Manufacturer Coupon” option. You’ll see the discount amount and a link to apply. About 73% of major drugmakers have their own savings portals, and most are easy to navigate.

Enrollment takes 5 to 10 minutes. You’ll need:

- Your full name and date of birth

- Your insurance information (plan name, member ID)

- Your prescription details (drug name, dosage, quantity)

- Your pharmacy’s name and address

Once you submit, you’ll get an email or text with a digital card. Some programs mail you a physical card. Either way, bring it to the pharmacy when you pick up your prescription.

How It Works at the Pharmacy

At the counter, the pharmacist scans your insurance card and your manufacturer coupon. A third-party administrator - like ConnectiveRx or Prime Therapeutics - checks if you’re eligible. If you are, they apply the discount right then and there. The pharmacy gets paid the full price by your insurer, and the manufacturer reimburses the difference. You pay only your reduced copay.It’s seamless - if everything lines up. But problems happen. Sometimes the pharmacy doesn’t recognize the coupon. Or your insurance plan blocks it because of an accumulator program. If that happens, ask the pharmacist to call the manufacturer’s help line. Most have a 24/7 support line for exactly this.

What’s Not Told to Patients

These programs aren’t charity. They’re marketing tools. A 2012 study found that for every dollar spent on a copay coupon, manufacturers got back $6 in sales. That’s because coupons make expensive drugs feel affordable. People stay on them longer - even when cheaper generics exist.They also keep brand drugs priced high. Without coupons, many patients would switch to generics. But with a $10 copay, the $500 price tag doesn’t matter. That’s why drug companies fight hard to keep these programs alive - even as lawmakers try to shut them down.

And they’re not forever. Most programs last 12 to 24 months. After that, you have to reapply. Some companies auto-renew. Others don’t. I’ve seen Reddit threads from people who lost their $500/month discount overnight because they forgot to renew. One user wrote: “My Humira coupon expired. I had to pay $1,200 the next month. I couldn’t afford it.”

Manufacturer Programs vs. Pharmacy Discount Cards

GoodRx, SingleCare, and other pharmacy discount cards are different. They’re not tied to manufacturers. They work for both brand and generic drugs. The savings? Usually 30% to 60%. Not as deep as manufacturer coupons, but more reliable.Key difference: Pharmacy cards do work for Medicare and Medicaid users. They also count toward your deductible. And they’re not subject to accumulator programs. So if your insurance blocks manufacturer coupons, a GoodRx card might be your only option.

Here’s a quick comparison:

| Feature | Manufacturer Savings Program | Pharmacy Discount Card (e.g., GoodRx) |

|---|---|---|

| Works for Medicare/Medicaid? | No | Yes |

| Applies to generics? | No | Yes |

| Average savings | 70%-85% | 30%-60% |

| Counts toward deductible? | Usually not | Yes |

| Duration | 12-24 months, often requires renewal | No expiration |

| Requires insurance? | Yes | No |

Real Stories: What Works and What Doesn’t

A 58-year-old woman in Ohio with type 2 diabetes was paying $562.50 a month for Jardiance. She enrolled in the manufacturer’s copay card. Her new monthly cost? $100. She saved over $5,500 a year.Another man in Texas with psoriasis used Humira. His copay dropped from $400 to $25. He kept using the coupon for 18 months - until the manufacturer suddenly stopped it. He had no warning. His out-of-pocket jumped to $800. He had to switch to a biosimilar, which wasn’t as effective.

A 2023 survey by the Medicare Rights Center found that 42% of people using these programs ran into problems - either their insurance blocked the discount, the program expired, or they were denied because of income limits.

What to Watch Out For

- Accumulator programs: Check your insurance plan’s summary of benefits. Look for “manufacturer coupon restrictions” or “accumulator adjustment.” If it’s there, your discount won’t help you reach your out-of-pocket max.

- Program expiration: Set a calendar reminder 30 days before your coupon expires. Renew early. Don’t wait.

- Pharmacy issues: Not all pharmacies accept every coupon. Call ahead. Ask if they process manufacturer savings.

- Plan changes: If your insurance switches carriers or you change jobs, your coupon might stop working. Re-enroll immediately.

According to a 2023 KFF study, 65% of patients needed help from their pharmacist just to enroll. Don’t be afraid to ask. Pharmacists see this every day.

What’s Changing in 2025

More states are passing laws to ban accumulator programs. As of 2025, 32 states have done so. That’s good news - it means your discount might finally count toward your deductible.At the federal level, the 2023 Fair Deal for Patients Act is moving through Congress. If passed, it would force manufacturers to let their discounts count toward deductibles. That would make these programs fairer - but it could also lead to fewer coupons being offered.

Drugmakers are already preparing. Some are shifting toward longer-term programs or bundling discounts with telehealth services. Others are quietly reducing the maximum annual benefit - from $15,000 down to $10,000.

Final Steps: How to Use These Programs Right

1. Check eligibility: Are you on private insurance? Not Medicare or Medicaid? Then you can likely use a coupon. 2. Find the program: Go to the drugmaker’s website or use GoodRx. Don’t trust third-party sites that aren’t official. 3. Enroll early: Do it before your prescription runs out. You don’t want to be without medication. 4. Confirm with your pharmacy: Call ahead. Ask: “Do you accept manufacturer copay cards for [drug name]?” 5. Track expiration: Mark your calendar. Set a reminder. Renew before it ends. 6. Have a backup: Keep a GoodRx card handy. If the manufacturer program drops, you’ll still save money.These programs aren’t perfect. They’re designed to keep people on expensive drugs. But for now, they’re the best tool most people have to afford life-saving medications. Use them wisely. Know the rules. And never assume they’ll last forever.

Prem Hungry November 17, 2025

man i been usin this for my insulin n it saved my life frfr

Leslie Douglas-Churchwell November 19, 2025

Let’s be clear: these ‘savings programs’ are a corporate psyop designed to entrench pharmaceutical monopolies under the guise of benevolence. The 6:1 ROI? That’s not charity-it’s behavioral conditioning. You’re being manipulated into dependency while the FDA looks the other way. And don’t get me started on accumulator programs-they’re not policy, they’re sabotage. 🤡💸

Jeremy Hernandez November 20, 2025

lol at people who think these programs are actually helping. they’re just a marketing tactic to keep you on the $500 drug instead of the $10 generic. if your doc prescribes you the brand without checking alternatives, they’re either lazy or getting kickbacks. i’ve seen it a hundred times. just ask for the generic. it’s the same damn thing.

Tarryne Rolle November 22, 2025

It’s ironic, isn’t it? We’ve built a system where compassion is commodified. The very mechanism meant to alleviate suffering becomes a tool of corporate control. The coupon isn’t kindness-it’s a leash. And we cheerfully wear it, convinced we’ve won the game when we’ve merely been reprogrammed to consume more efficiently. The tragedy isn’t the price-it’s that we’ve stopped asking why it must be this way.

Kyle Swatt November 22, 2025

These programs are a godsend if you’re stuck between a rock and a hard place-like me with my RA meds. But yeah, they’re a trap wrapped in a discount. The drug companies know you’ll stay on the brand because it feels cheap. And when the coupon expires? You’re left holding the bag with a $1200 bill. I’ve been there. That’s why I keep a GoodRx card in my wallet like a spare tire. Always have a backup. Life’s messy. Don’t trust the system to be fair.

Deb McLachlin November 22, 2025

Thank you for this comprehensive breakdown. I’m particularly interested in the legislative developments mentioned regarding accumulator programs. Could you clarify which states have enacted bans as of 2025? Additionally, are there any peer-reviewed studies analyzing long-term patient outcomes under these programs versus generic alternatives? The ethical implications warrant deeper scholarly attention.

saurabh lamba November 23, 2025

bro i just use goodrx now. why deal with all that crap? manufacturer stuff expires, insurance blocks it, you gotta reapply every year. goodrx works for everything, even generics, and it's free. no drama. why make life harder?

Kiran Mandavkar November 25, 2025

Let’s not romanticize these programs. They exist because the U.S. healthcare system is a grotesque, unregulated oligopoly. The fact that a patient must navigate a labyrinth of corporate loopholes just to afford insulin is not a feature-it’s a crime. The real solution isn’t better coupons-it’s single-payer. Everything else is just rearranging deck chairs on the Titanic while the pharmaceutical CEOs cash their bonuses.

Eric Healy November 26, 2025

Y’all keep talkin bout GoodRx like its magic. But it dont work on all drugs. And the savings? Half the time its less than the copay card. Plus, the pharmacy will screw you if they dont know how to process it. I had a guy at Walgreens tell me ‘we dont take that’ even though it was legit. You gotta call ahead. Or just suck it up and pay full price. Either way, the system wins.

Shannon Hale November 27, 2025

OMG I JUST GOT MY HUMIRA COUPON RENEWED AND I CRIED IN THE PHARMACY LINE 😭😭😭 I WAS SO AFRAID I’D HAVE TO CHOOSE BETWEEN FOOD AND MEDS AGAIN. THIS IS THE ONLY THING KEEPING ME ALIVE. WHOEVER MADE THIS GUIDE IS A GODDESS. I’M TELLING EVERYONE. #SaveOurSavings #PharmaIsAScamButThisIsOurLifeline

Holli Yancey November 28, 2025

I appreciate how detailed this is. I’ve been using a copay card for my asthma inhaler for two years now. I didn’t realize the accumulator program was working against me until last month. I just called my insurer and asked them point-blank: ‘Does your plan apply manufacturer discounts to my out-of-pocket maximum?’ They said no. I’m switching plans next year. It’s exhausting, but I’m not giving up.

Gordon Mcdonough November 30, 2025

THIS IS WHY AMERICA IS BROKE. CORPORATIONS GIVE YOU A LITTLE TO KEEP YOU FROM DEMANDING THE WHOLE THING. YOU THINK YOU’RE WINNING WITH YOUR $10 COUPON? YOU’RE JUST A SHEEP. THEY’RE MAKING BILLIONS OFF YOUR DESPERATION. AND NOW WE’RE SUPPOSED TO BE GRATEFUL? I’M NOT. I WANT FREE MEDS. I WANT HEALTHCARE AS A RIGHT. NOT A GAME OF CHASE THE COUPON.