Alcohol Dependence Syndrome is not just a personal struggle; it brings substantial financial repercussions, too. Many people underestimate how deep the monetary impact of alcohol addiction goes.

When we talk about these financial effects, it's crucial to understand both the direct and indirect costs. From spending on alcohol itself to health-related expenses, legal fees, and even lost productivity at work, the total can be staggering.

Let’s dive into what makes these costs so high and explore strategies to manage and reduce them effectively. Understanding these aspects can help frame better support networks and offer practical advice to those in need.

- Direct Costs of Alcohol Dependence

- Indirect Financial Consequences

- Managing and Reducing Costs

- Support and Resources

Direct Costs of Alcohol Dependence

When dealing with alcohol dependence, many individuals and families find themselves confronting substantial financial burdens. One of the most visible costs is the regular expense of purchasing alcohol. For someone with alcohol dependence, this isn't just a casual expense; it can quickly add up to significant amounts that disrupt their budget. Imagine spending $20 or more daily on alcohol. Over the course of a month, this expense can surpass $600.

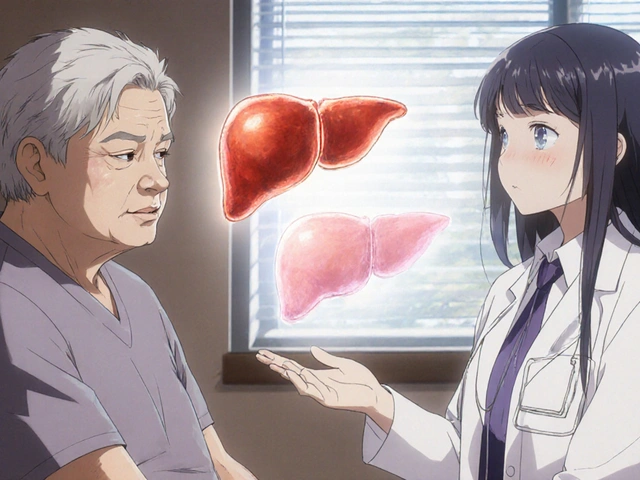

Beyond the purchase of alcohol, the dependency often necessitates frequent medical expenditures. Routine doctor's visits, treatments for alcohol-related health issues such as liver disease or cardiovascular problems, and medications can be costly. For instance, treating liver disease may involve expensive medications and regular check-ups that can strain even a well-prepared budget.

Another overlooked but critical aspect is the cost of rehabilitation programs. These can range from outpatient services that cost a few thousand dollars to inpatient programs that may exceed $10,000 per month. While insurance might cover some of these costs, out-of-pocket expenses can still be overwhelming for many families.

Legal fees are also a significant concern. Many with alcohol dependence face legal issues, such as DUIs or public intoxication charges. Legal representation, fines, and increased insurance premiums can lead to thousands of dollars in extra costs. According to the National Institute on Alcohol Abuse and Alcoholism, alcohol-related problems cost the US nearly $249 billion annually, much of which is borne by affected individuals and their families.

"The financial toll of alcohol addiction extends beyond medical and legal expenses. It also impacts one's earning potential, leading to lasting economic consequences," notes Dr. John Smith, an expert in addiction medicine.

Lastly, the cost of property damage is an unfortunate reality for many struggling with alcohol dependence. Accidents at home or in vehicles while intoxicated can result in thousands of dollars in repair and replacement costs, not to mention the emotional toll these events take on everyone involved.

Recognizing and understanding the direct costs of alcohol dependence is essential for anyone looking to better support individuals suffering from this condition. It's not just about the money spent on drinks; it’s the cumulative financial impact that touches every part of life, affecting health, legal standing, and overall quality of life.

Indirect Financial Consequences

The indirect financial consequences of alcohol dependence can often be even more significant than the direct costs. One major aspect is the impact on job performance and work productivity. Individuals struggling with alcohol dependence may experience increased absences, tardiness, or a general decline in work performance. This not only affects their income but can also lead to job loss, which brings about a range of financial struggles, such as the cost of job searching and potential periods without income.

Additionally, relationships often suffer, leading to potential legal fees and settlements in cases of divorce or custody battles. The emotional strain placed on families can lead to therapy or counseling costs, which are often ongoing and can accumulate quickly. Families might find themselves covering for missed bills, medical payments, or providing financial support to the affected individual.

Health problems result from prolonged alcohol use. Issues like liver disease, heart problems, and mental health disorders often require ongoing medical attention. According to a study by the National Institute on Alcohol Abuse and Alcoholism, medical costs for treating alcohol-related health issues can run into thousands of dollars annually. This doesn't even consider the indirect impact on family health, with stress-related illnesses and mental health concerns.

Insurance premiums may also rise due to the high-risk behaviors associated with alcohol dependence. A person with a history of alcohol-related incidents might find their auto insurance rates increasing or even facing cancellation. With health issues in play, life insurance rates might also skyrocket, adding another significant financial burden.

Another serious indirect cost is the potential for legal issues. Alcohol dependence often leads to impaired driving or other legal infractions, resulting in fines, court costs, and even jail time. A DUI, for example, can have severe financial consequences, from legal fees to higher insurance premiums and lost wages due to time off work for court appearances or incarceration.

"The economic burden on a family dealing with alcohol dependence can be devastating," says Dr. Lynn Fiellin, a Yale School of Medicine professor specialized in addiction medicine. "It's not just the immediate medical costs but the ripple effect on every aspect of life that creates long-term financial instability."

Social stigma and loss of social standing can indirectly affect careers and networking opportunities. Professional relationships often suffer, potentially resulting in missed promotions or new job opportunities.

Children in families where a parent has alcohol dependence may also face indirect financial consequences. They might need additional educational support or counseling. In many cases, children from these families have less financial assistance for college or other educational opportunities due to the financial strain the family is under.

Summing up, the indirect consequences of alcohol dependence reach far beyond the individual, impacting family, friends, and society at large. By understanding and addressing these broader implications, individuals and support networks can better prepare for and mitigate the extensive financial challenges that come with alcohol dependence.

Managing and Reducing Costs

Dealing with the financial burden of alcohol dependence can feel overwhelming, but understanding where your money is going is the first step in taking control. One practical approach is to start tracking your expenses. This means noting every penny spent on alcohol and related activities. Whether it's a $10 bottle of wine or a weekend bar tab, it all adds up. By seeing where your money goes, you can identify patterns and better understand the financial impact of the addiction.

Creating a budget can also be incredibly helpful. Allocate specific amounts to essential expenses like rent, groceries, and utilities. Clearly limit the amount you allow yourself to spend on alcohol, if at all. Budgets help you acknowledge the true cost of your habits and can motivate you to stick to healthier choices. Many mobile apps and online tools can simplify this process for you.

Cutting down on alcohol doesn’t just save money; it can also pave the way for eligibility for various types of insurance and financial products. For example, life insurance premiums can be lower for those who don’t drink or drink very little. Insurers see a lower risk, translating to financial savings on your end. This can open up new opportunities for long-term financial planning.

Investing in **treatment programs** is another way to manage these costs more effectively over time. Although rehab or counseling can be expensive upfront, the long-term financial relief of cutting out alcohol usually outweighs initial spending. Look for programs that offer sliding scale fees or accept insurance. Some community centers and non-profit organizations provide resources at reduced rates or even for free.

According to the National Institute on Alcohol Abuse and Alcoholism (NIAAA), "Every dollar invested in addiction treatment programs yields a return of $4 to $7 in reduced drug-related crime, criminal justice costs, and theft."

Community support groups, such as Alcoholics Anonymous (AA), provide free assistance and peer support. Joining such groups not only gives emotional backing but also contributes to cost reduction by lessening dependence on paid services and therapies. Plus, the shared experiences can offer practical tips for saving money and managing expenses related to recovery.

Lastly, consider making lifestyle changes that naturally curb alcohol spending. Engage in hobbies or activities that don’t involve drinking. Sports, arts and crafts, or even home improvement projects can serve as excellent distractions and offer productive use of your time. These activities often lead to healthier habits, both physically and financially. By shifting your focus to such positive outlets, you may find it easier to reduce alcohol consumption, indirectly lowering its financial load.

Support and Resources

When dealing with Alcohol Dependence Syndrome, finding the right support and resources is essential for both recovery and managing the financial aspects associated with the condition. Numerous organizations and online platforms offer various forms of assistance including counseling, financial advice, and support groups. While you might initially feel alone in this battle, countless resources are designed specifically to help people in your situation.

One of the most well-known organizations is Alcoholics Anonymous (AA). This group offers a strong community for individuals looking for peer support while recovering from addiction. The beauty of AA is its global presence; no matter where you are, there is likely a chapter near you. Beyond just meetings, AA provides literature and resources that can be invaluable in your journey.

"I found strength in the support system of AA. The financial burden seemed less overwhelming when shared with those who understood." — Anonymous AA Member

In addition to peer support, professional counseling and therapy can provide essential tools for coping with the psychological aspects of addiction. Many therapists specialize in addiction and can help design a tailored treatment plan. Insurance often covers these services, which can significantly reduce the financial strain. It's worthwhile to check with your provider to understand what services are included.

For those who find the cost of therapy prohibitive, free hotlines and online forums can offer immediate support. Websites like Alcohol.org provide a wealth of information on managing both the physical and financial impact of alcohol dependence. Some platforms even offer free access to sobriety coaches who guide you day-to-day.

Managing finances during this period is crucial. Financial advisors who specialize in dealing with addiction-related expenses can help you budget effectively. Some advisors also offer pro bono services or sliding scale fees, making their advice accessible regardless of your financial situation.

Government and Insurance Resources

Government programs often provide additional layers of support. Medicaid in the United States, for example, covers many forms of addiction treatment. Community health centers funded by government grants may also offer free or low-cost therapy services. Checking your eligibility for these programs can open doors to much-needed resources.

Another critical resource is insurance. The Affordable Care Act (ACA) requires coverage for substance abuse treatment, which means your insurance plan might already cover many of the services you need. Understanding your insurance benefits can go a long way in reducing out-of-pocket expenses. Contact your provider to clarify what’s included and ensure you utilize all available benefits.

Finally, local charities and non-profits often provide grants or financial assistance to help cover treatment costs. Organizations like the Substance Abuse and Mental Health Services Administration (SAMHSA) maintain directories of such resources. Reaching out to these organizations can significantly alleviate financial stress.

![Buy Cheap Generic Cialis (Tadalafil) Online UK: Safe Options, Prices & Risks [2025]](/uploads/2025/08/thumbnail-buy-cheap-generic-cialis-tadalafil-online-uk-safe-options-prices-risks.webp)

Mark Anderson July 24, 2024

Wow, this deep dive into the dollars‑and‑cents side of alcohol dependence really shines a light on the hidden avalanche of expenses many folks don't even see. From the daily bottle that can drain a paycheck to the towering rehab bills that stack up faster than a skyscraper, the numbers are staggering. One trick that’s worked for many I’ve chatted with is to set up a “hard‑stop” cash envelope for any alcohol‑related spending – once it’s empty, the habit hits a natural pause. Pair that with a simple spreadsheet tracking every booze‑related line item; the visual impact can be a real eye‑opener. And don’t forget the insurance angle – lowering your risk profile by cutting back can shave dozens off your premium each year, freeing up cash for healthier pursuits. Community resources, like local AA chapters or free counseling hotlines, can also slash costs while offering solid support. Remember, every dollar saved on the habit is a dollar you can redirect toward building a steadier future for yourself and your loved ones. Keep pushing forward, you’ve got this!

Shouvik Mukherjee July 24, 2024

In many cultures, the conversation around financial strain from alcohol often stays behind closed doors, but opening that dialogue can be the first step toward easing the burden. Families in India, for example, have started community circles where members share budgeting tips and pool resources for group counseling sessions, which reduces the individual cost dramatically. It’s also vital to explore government‑run health schemes that may cover part of treatment expenses; a little paperwork can lead to big savings. By encouraging one another to track spending and seek out low‑cost support networks, we build a safety net that catches more than just monetary slips – it catches hope too.

Ben Hooper July 24, 2024

The hidden legal fees alone can cripple a family’s finances.

Marjory Beatriz Barbosa Honório July 24, 2024

Finding the courage to face the financial side of alcohol dependence can feel overwhelming, but you’re not alone in this journey. I’ve seen people turn simple habit‑tracking apps into powerful tools that shine a light on where every dollar disappears, turning confusion into clarity. Pair that awareness with a supportive buddy system – someone you trust can help you stay accountable without judgment. When it comes to treatment, many clinics offer sliding‑scale rates based on income, so don’t assume cost is a barrier before you ask. Remember, each small step you take – whether it’s cutting back a single drink or setting aside a modest savings pot – builds momentum toward a brighter, more stable future. Keep believing in your progress; the financial freedom you seek follows the same path as personal recovery.

G.Pritiranjan Das July 24, 2024

Tracking expenses in a simple spreadsheet can quickly reveal unnecessary spending and open up room for savings.

Karen Wolsey July 24, 2024

Oh sure, navigating endless paperwork for subsidies feels just as fun as watching paint dry, but at least it sometimes uncovers a hidden grant you never imagined.

Trinity 13 July 24, 2024

It’s funny how the bureaucracy treadmill that Karen just described can feel like a cosmic joke, where the very systems designed to help us end up demanding a Ph.D. in patience just to get a single slot of relief. Yet, when you peel back the layers, you realize that this maze mirrors the internal labyrinth of addiction itself – a series of twists, dead ends, and occasional hidden doors that lead to unexpected freedom. The first lesson is to accept that the process will be messy; you won’t find a tidy checklist that magically resolves every financial knot. Instead, you cultivate a mindset that treats each form filled out, each phone call made, as a small victory in reclaiming agency over your wallet and your life. Think of each bureaucratic hurdle as a workout for your resolve, strengthening the muscle that says “I will not be defeated by red tape.” Moreover, community solidarity becomes your secret weapon – a neighbor who’s already navigated the same forms can hand you a cheat sheet, saving you hours of trial and error. When you combine that shared knowledge with the discipline of budgeting, the numbers you once feared start to make sense, like puzzle pieces finally fitting together. It’s also crucial to remember that the financial strain isn’t just a number on a spreadsheet; it’s a story about priorities, values, and the kind of life you want to build after recovery. By reframing expenses as investments in health, stability, and future dreams, you shift the narrative from loss to empowerment. Finally, celebrate the tiny wins: a reduced insurance premium, a dollar saved from a single night out, a grant that covers half of a therapy session. Those moments accumulate, creating a ripple effect that can turn the tide of financial despair into a tide of possibility. So, while the paperwork might feel like a never‑ending saga, every signature you put down is a line in the larger story of reclaiming control, and that story, my friend, is worth every painstaking paragraph you endure. Remember, the journey isn’t a sprint but a marathon, and pacing yourself through the administrative stretch will save you burnout later. You might also set a weekly “admin hour” dedicated solely to chasing paperwork, turning chaos into routine. In the end, the financial freedom you gain becomes the foundation for a healthier, more resilient life beyond the bottle.