The global generic drugs market isn’t just surviving-it’s adapting. As healthcare systems buckle under rising costs and aging populations, generics remain the backbone of affordable medicine. But the rules are changing. What worked in 2020 won’t cut it in 2030. The future belongs to those who understand the shift from cheap pills to complex biologics, from volume-driven production to quality-controlled supply chains, and from India and China as the world’s pharmacy to a more distributed, resilient network of manufacturers.

Why Generics Still Matter More Than Ever

Generic drugs make up 90% of prescriptions in the U.S. and over 70% in Germany, yet they account for less than a quarter of total drug spending. That’s not a bug-it’s the whole point. When a brand-name drug loses patent protection, generics step in and slash prices by 80-85%. In 2024, the FDA confirmed that generics saved U.S. patients and insurers over $370 billion in a single year. That kind of savings isn’t optional anymore. With global healthcare spending hitting $9.8 trillion in 2024 and chronic diseases affecting 41% of the world’s population, the pressure to cut costs is only getting worse.

It’s not just the U.S. or Europe. Countries like Brazil, Turkey, and Egypt are mandating local generic production. Egypt now requires 50% of essential medicines to be made domestically by 2025. Saudi Arabia’s Vision 2030 is pouring billions into building its own pharmaceutical infrastructure. These aren’t just policy shifts-they’re survival tactics for nations that can’t afford to rely on imports for life-saving drugs.

The Rise of Biosimilars: The New Frontier

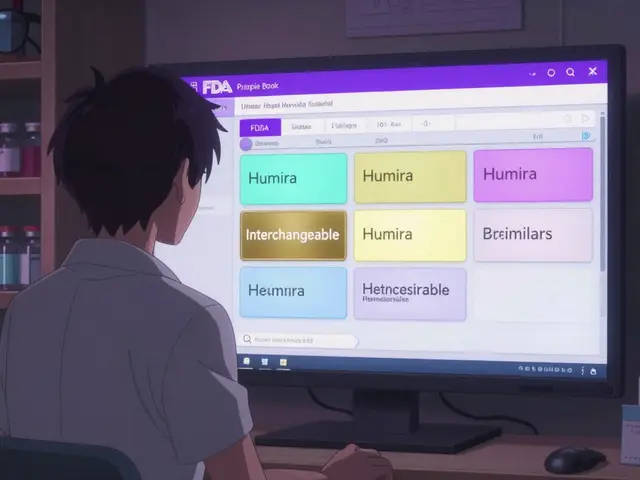

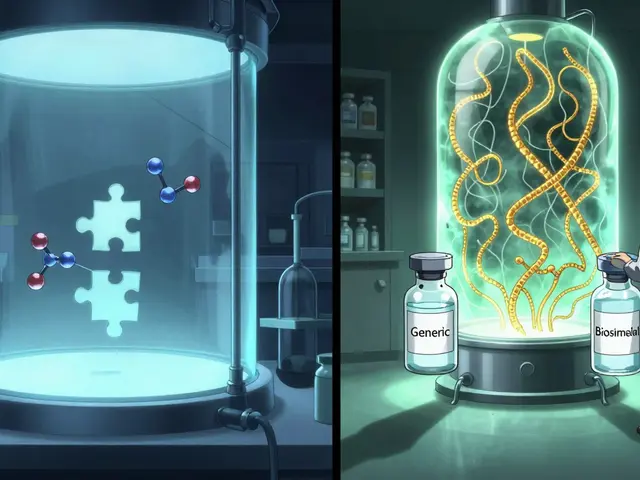

For decades, generics meant small-molecule pills-simple chemical copies of drugs like atorvastatin or metformin. But that’s changing fast. The fastest-growing segment now is biosimilars: copies of complex biologic drugs like Humira, Enbrel, and Keytruda. These aren’t just pills. They’re living molecules grown in cell cultures, requiring 10-20 times more manufacturing steps than traditional generics. Development costs? $100-250 million per product. That’s a far cry from the $1-5 million needed for a standard generic.

But here’s the catch: biosimilars don’t cut prices by 85%. They’re priced 15-30% below the original biologic. Still, that’s huge when the original costs $100,000 a year. In 2024, over 100 biosimilars were approved globally, with oncology and autoimmune diseases leading the charge. Mordor Intelligence predicts this segment will grow at 12.3% annually through 2030-far outpacing traditional generics.

Smaller manufacturers can’t compete here. You need labs that can replicate protein folding, strict cold-chain logistics, and regulatory expertise that few countries have. That’s why big players like Sandoz, Amgen, and Samsung Bioepis are dominating. But for emerging markets, biosimilars are a chance to leapfrog into high-value manufacturing. India’s Biocon and China’s Sinopharm are already investing heavily. The next decade will see biosimilars become the new standard for treating cancer, diabetes, and rheumatoid arthritis.

Where the Growth Is: Pharmerging Markets

North America and Western Europe? Growth is flat. Price controls, reimbursement cuts, and saturated markets mean generic manufacturers there are fighting over scraps. The real action is in the pharmerging markets-countries like India, China, Brazil, Turkey, and Egypt. These markets are growing at 9.66% annually, according to Mordor Intelligence. Why? Rising incomes, expanding insurance coverage, and government mandates.

India alone produces over 60,000 generic medicines and supplies 20% of the world’s generic drug volume by volume. China makes 40% of the global supply of active pharmaceutical ingredients (APIs)-the raw building blocks of every pill. But it’s not just about production. These countries are building their own regulatory systems. India’s National Pharmaceutical Pricing Authority sets price caps. China’s ‘Healthy China 2030’ pushes local manufacturing. Brazil is tightening import rules to favor domestic producers.

The Middle East is catching up fast. Saudi Arabia’s pharmaceutical market is projected to hit $9.89 billion by 2025. The UAE is investing in GMP-certified plants. Even Egypt, which once imported 80% of its medicines, is now requiring local production. These aren’t just markets-they’re emerging manufacturing hubs with long-term ambition.

The Supply Chain Problem: Who Makes the Ingredients?

Here’s the dirty secret: most generic drugs are made from ingredients produced in just two countries. China supplies 65% of the world’s APIs for generics. India produces the finished pills. That’s a dangerous concentration. In 2020, when COVID shut down Chinese factories, global shortages hit hard. Insulin, antibiotics, even basic painkillers disappeared from shelves.

The FDA issued 187 warning letters to foreign generic manufacturers in 2023-40% of all warning letters went to facilities in Asia. Quality control remains a major concern. One contaminated batch can trigger recalls across continents. That’s why the U.S., EU, and now even Saudi Arabia are pushing for supply chain diversification. The U.S. Inflation Reduction Act includes funding for domestic API production. India’s $1.34 billion Production Linked Incentive (PLI) scheme is trying to reduce reliance on Chinese chemicals.

But it’s not easy. Building API plants takes years and billions. Countries without chemical expertise can’t just switch overnight. The solution? Regional hubs. Africa is starting to develop API capacity in South Africa and Nigeria. Latin America is investing in Brazil and Mexico. It won’t replace China overnight, but it will reduce risk.

Competition Is Getting Fierce-and Profit Margins Are Shrinking

When you have hundreds of companies making the same generic drug-say, metformin or lisinopril-price wars are inevitable. In 2020, generic manufacturers enjoyed 18% profit margins. By 2024, that dropped to 12%. Some drugs now sell for pennies per tablet. A 100-tablet bottle of generic atorvastatin costs less than $5 in the U.S. That’s barely enough to cover shipping.

Companies that survive are doing three things: becoming bigger, cutting out middlemen, and adding services. Big players like Teva and Mylan are merging. Others are moving upstream-owning API production instead of just buying it. Some are offering bundled services: medication adherence programs, digital health tracking, or even direct-to-patient delivery. It’s no longer enough to just make a pill. You have to prove you’re reliable, consistent, and connected.

Meanwhile, buyers are consolidating. Pharmacy Benefit Managers (PBMs) in the U.S. now control 80% of generic drug purchases. They demand lower prices, stricter quality audits, and faster delivery. Generic makers have less leverage than ever.

Regulatory Harmonization: The Silent Game-Changer

There are 78 different regulatory systems for drugs worldwide. Getting approval in the U.S., EU, Japan, and India used to mean five separate applications, five different sets of data, and five years of delays. That’s changing. The International Council for Harmonisation (ICH) now has 15 more member countries since 2024, including Egypt, Indonesia, and Colombia. More countries are adopting ICH standards for testing, documentation, and manufacturing.

This isn’t just bureaucracy. It’s a time-saver and a cost-saver. A company that can file once and get approved in multiple markets can bring products to market faster and cheaper. That’s a huge advantage for smaller players trying to break into global markets. It also means better quality control-because everyone’s following the same rules.

What’s Next? The 2030 Outlook

By 2030, the global generic market is expected to hit $650-700 billion. But here’s the twist: generics will make up a smaller share of total drug sales. In 2024, they accounted for 57.56% of pharmaceutical revenue. By 2030, that number is projected to drop to 53%. Why? Because biologics, gene therapies, and specialty drugs are growing faster. These drugs cost $100,000+ a year. Even with biosimilars, they’ll eat up a bigger slice of the pie.

But that doesn’t mean generics are fading. They’re evolving. The future belongs to manufacturers who can handle complexity-biosimilars, combination therapies, pediatric formulations, and rare disease drugs. It belongs to those who control their supply chain, not just their factory floor. And it belongs to companies that serve emerging markets with local production, not just exports.

The world still needs affordable medicine. The question isn’t whether generics will survive. It’s who will lead the next chapter-and whether the systems in place today can keep up.

Are generic drugs as safe as brand-name drugs?

Yes. Generic drugs must meet the same strict standards as brand-name drugs in every major market, including the U.S. FDA, EMA, and WHO. They contain the same active ingredients, work the same way, and are held to identical quality controls. The only differences are in inactive ingredients like fillers or colorants, which don’t affect safety or effectiveness. The FDA issues warning letters to manufacturers-regardless of brand or generic-who fail to meet these standards, and over 40% of those in 2023 targeted foreign generic facilities, not U.S. brands.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are copies of biologic drugs, which are made from living cells-not chemicals. Creating them requires complex processes like cell line development, fermentation, purification, and strict cold-chain storage. A single biosimilar can require 10-20 times more manufacturing steps than a traditional pill. Development costs range from $100 million to $250 million, compared to $1-5 million for a small-molecule generic. That’s why only large, well-funded companies can enter this space.

Which countries dominate generic drug manufacturing today?

India and China are the leaders. India produces over 60,000 generic medicines and supplies 20% of the world’s generic drug volume by volume. China manufactures about 40% of global active pharmaceutical ingredients (APIs)-the raw materials used to make pills. Together, they control roughly 35% of global manufacturing capacity. But other countries are catching up: Brazil, Egypt, South Africa, and Mexico are investing heavily in local production to reduce import dependence.

Is the global supply chain for generics at risk?

Yes. China supplies 65% of the world’s APIs for generics, and India relies on China for many key chemicals. A single disruption-like a pandemic, trade war, or factory shutdown-can cause global shortages. The FDA issued 187 warning letters to foreign generic manufacturers in 2023, many linked to quality issues in these supply chains. Governments are now pushing for diversification: the U.S. is funding domestic API production, India has a $1.34 billion incentive program, and countries like Saudi Arabia and Egypt are building their own manufacturing bases.

Will generic drug prices keep falling?

For simple, old drugs-yes. Prices for common generics like metformin or lisinopril have dropped to pennies per tablet due to intense competition. But for newer, complex generics-especially biosimilars-prices are stabilizing. Biosimilars cost $100-250 million to develop and are priced 15-30% below the original biologic, not 80% lower. As more of these enter the market, they’ll bring down costs for expensive treatments like cancer drugs, but not as dramatically as traditional generics did. Profit margins are shrinking overall, so manufacturers are focusing on volume, efficiency, and service, not just price.

Stephen Adeyanju November 26, 2025

This is literally the most important thing nobody is talking about

Imagine your insulin runs out because some factory in China got a power outage

And then you die because the US government cares more about tariffs than your life

WHY ISN'T THIS ON THE EVENING NEWS

james thomas November 26, 2025

Of course the FDA is issuing warning letters to Asian manufacturers. Meanwhile, Big Pharma is quietly buying up every biosimilar patent they can find. This isn't about safety-it's about control. The real drug crisis isn't shortages, it's monopoly. The same CEOs who priced Humira at $70k a year now want to own the $20k biosimilar version too. Wake up. This system is rigged.

Deborah Williams November 27, 2025

It's funny how we treat medicine like a commodity when it's the closest thing we have to a human right.

India and China aren't just 'manufacturers'-they're the unsung caregivers of the global poor. And now we're asking them to build entire pharmaceutical ecosystems overnight while we panic about 'supply chain resilience' like it's a Netflix documentary. Meanwhile, our own hospitals can't afford to stock basic antibiotics. The real tragedy isn't the lack of pills-it's the lack of moral imagination.

Micaela Yarman November 28, 2025

The regulatory harmonization efforts under ICH represent a monumental, if underappreciated, advancement in global public health infrastructure. The adoption of standardized protocols across 15 additional jurisdictions significantly reduces redundant testing, accelerates market access, and enhances quality assurance for patients in low- and middle-income countries. This is not bureaucratic noise-it is structural progress.

Brittany Medley November 30, 2025

Just to clarify: biosimilars aren't 'cheaper generics'-they're complex biologics with similar, but not identical, structures. The 15-30% price drop sounds small, but when the original is $100K/year, that’s still $15K-$30K saved per patient. And yes, cold chain logistics are a nightmare-some biosimilars need -80°C storage. Not your grandma’s aspirin.

Marissa Coratti December 2, 2025

I find it profoundly concerning that the very systems designed to ensure equitable access to life-saving medications are now being reshaped by geopolitical competition, profit-driven consolidation, and fragmented regulatory landscapes-when what we truly need is a unified, human-centered framework that prioritizes health outcomes over market share, especially in regions where even basic diagnostics remain inaccessible, and where the most vulnerable populations are left to navigate the fallout of supply chain fragility with no safety net whatsoever.

Ali Miller December 2, 2025

China is poisoning our medicine. 65% of APIs? That’s national security failure #1. We let them own our pills while they build missiles. The U.S. needs to nationalize API production NOW. No more imports. No more ‘collaboration.’ If we can send drones to the other side of the world, we can build a damn chemical plant in Ohio. 🇺🇸💊 #MakePillsGreatAgain

Amanda Wong December 3, 2025

You say ‘India produces 60,000 generics.’ That’s not a badge of honor. That’s a sign of regulatory capture. Half those drugs wouldn’t pass a basic lab test in the EU. And now we’re supposed to trust Egypt’s new ‘local production’? Please. The FDA’s 187 warning letters aren’t coincidences-they’re patterns. This isn’t globalization. It’s exploitation dressed up as affordability.

Asia Roveda December 3, 2025

Let’s be real-nobody cares about this unless it’s their kid who can’t get insulin. Until then, it’s just data points and PowerPoint slides. We’ll all cheer when the biosimilar hits the market, then forget about it until the next shortage. The system doesn’t need fixing. It needs a conscience.

mohit passi December 5, 2025

As someone from India, I see this every day. Our labs make pills for the world, but our own hospitals struggle to stock them. PLI scheme? Good start. But where are the doctors? The clinics? The training? We can make the medicine-but we still need the system to deliver it. 🇮🇳💊 #NotJustManufacturing #HealthForAll